Trina Solar featured in independent agency report: With superior value, large-format modules will account for about 80% of market share this year

Ultra-high power modules have quickly become a mainstream market choice, something that has been perceivable in the photovoltaic industry since last year. The New Technology Market Report published in February by PV InfoLink, a division of independent analysis agency InfoLink, provided detailed data on size, cell and module developments, along with projected future trends. The switch to large-format modules is irresistible from the perspective of industrial chain support, cost reduction, production capacity and market share, the report says.

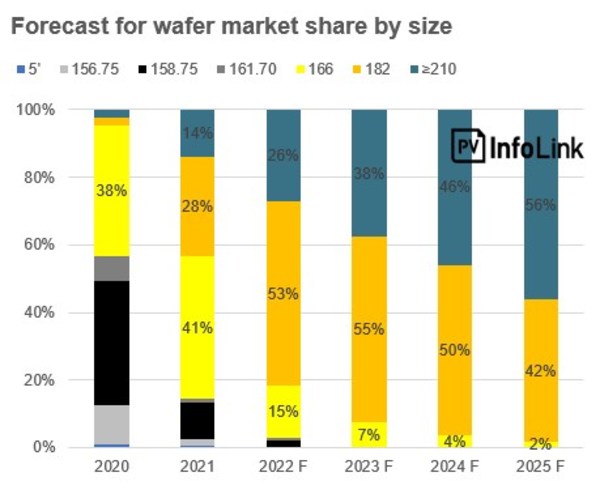

Share of large-format wafers exceeded 50%, 210mm wafer becomes mainstream

According to PV InfoLink’s report, examining the large-wafer production capacity of leading wafer manufacturers, wafer makers have started to increase their output ratio of large-format wafers considering the cost advantage in each link. With the completion of older projects, there has been a rapid decline in total demand and output of 158.75mm (G1) wafers and cells since the third quarter of 2021. Affected by large-format wafers, there has been dramatic reduction in market share of wafers of the 166mm (M6) size and other smaller sizes, and a shift to larger wafers has occurred.

According to the report, with the accelerated shift to larger wafers in the second half of last year, large-format wafers accounted for more than 50% of market share in the third quarter and continued to rise. As seen in the report, market share of large-format wafers (including 182mm and 210mm) is expected to reach 79% this year. Moreover, the market is moving forward with 210mm wafers, which has been a mainstream choice with a continuously rising market share. Taking leading wafer maker Zhonghuan Semiconductor as an example, the proportion of 210mm wafers increased from 43% in the first quarter of last year to 72% in the fourth quarter.

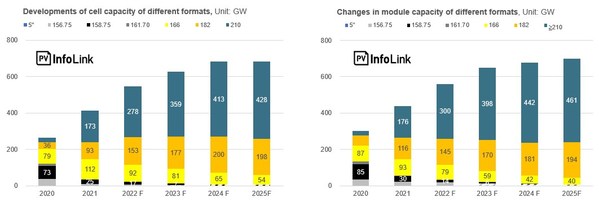

By the end of last year, cell production lines accommodating sizes up to 182mm and 210mm reached 266 GW, while large-format modules reached 292GW. Because of equipment compatibility, the production capacity of 210mm modules reached beyond 170 GW, higher than that of 182mm modules. According to the report, the production capacity of large cells and modules is expected to rise year by year by 2025. In Southeast Asia Trina Solar has had a production capacity of 210mm modules. Based on favorable external policies and market development, a number of module manufacturers are expected to expand their production capacity in many places around the world.

According to PV InfoLink’s previous report, by the end of last year there were more than 50 module manufacturers with production capacity of high-power, large-format modules. Among them, more than 30 manufacturers had achieved mass production of modules featuring cell format up to 210mm, and the proportion continues to rise. Most of the new wafer production capacity is also of the larger size, rising year by year to ensure supply.

In terms of cost advantage, the current non-silicon cost of 166mm PERC cells is about 0.2-0.23 yuan a watt, while that of large cells is about 0.17-0.21 yuan a watt. With the mature PERC technology, the introduction of large cells and the improvement in efficiency and yield of large cells have become the main cost reduction factors for large PERC cells. According to PV InfoLink’s report, the cost reduction brought by the large-format has led to huge capacity expansion of PERC cell. Last year, the new production capacity of large-format PERC exceeded 170 GW, which has also resulted in a significant reduction of market share of polycrystalline and n-type cells.

Trina Solar states: “Taking the ultra-high power module based on PERC technology as an example, according to the previous Fraunhofer ISE study made in Germany(Nyheter), the system value of the G12 210mm Vertex 670W mono-facial and bifacial modules is significantly higher than that of the M10 540W and M10 585W modules, and LCOE is reduced by up to 7.4%.”

With superior reliability and value advantages, large-format modules are improving the safety and efficiency of the entire photovoltaic system, reducing LCOE cost, and accelerating as well as upgrading the whole industry globally.